California-based C3bank moves into Nashville market

|

Our expansion to Nashville, TN was recently covered in the Nashville Business Journal! Read the whole article HERE. Our expansion to Nashville, TN was recently covered in the Nashville Business Journal! Read the whole article HERE.

|

|

C3bank's New Board of Directors Member: Drew Brees

|

C3bank recently appointed a new member to the Board of Directors, Drew Brees, business owner, commercial real estate investor, global philanthropist, and former quarterback of the New Orleans Saints and San Diego Chargers. C3bank recently appointed a new member to the Board of Directors, Drew Brees, business owner, commercial real estate investor, global philanthropist, and former quarterback of the New Orleans Saints and San Diego Chargers.

"We are thrilled to welcome our newest Board member, whose values align seamlessly with our commitment to the community. Drew brings extensive expertise in business and social outreach, making him a highly valuable addition to our Board of Directors," said A.J. Moyer, President & CEO.

With an Industrial Management degree from Purdue University, Drew pursued further education at the Stanford Graduate School of Business focusing on Business Management and Entrepreneurship. Drew's 20- year National Football League legacy is marked by 13 Pro Bowl appearances and crowned Super Bowl MVP during the Saints' victory in 2010. Beyond the NFL, Drew is leaving a lasting mark through many successful entrepreneurial ventures in commercial real estate investment, franchise ownership, and restaurant partnership.

Aside from his many business enterprises, Drew has left a notable impact on society by engaging in philanthropic initiatives, including five worldwide trips with the United Service Organizations (USO) and the creation of the Football N' America (FNA) League, a youth co-ed flag football league. Drew and his wife, Brittany, have significantly influenced charitable causes through the Brees Dream Foundation, contributing over $45 million to enhance cancer patients lives and support families in need.

Drew Brees's appointment to the Board of C3bank reaffirms the bank's commitment to the community, as it collaborates with forward-thinking leaders who align with our values. Together, we are actively enhancing community ties and shaping a collective future grounded in shared principles.

|

|

C3bank Expands to Nashville, Tennessee

|

C3bank proudly announces its expansion beyond California with the opening of a new location in Nashville, Tennessee, located within the Gulch district at 615 9th Ave. S. Nashville, TN 37203. This strategic move highlights C3bank's dedication to providing premier banking services to both local and nationwide customers. The Gulch, known for its mix of residential, commercial, and entertainment spaces, serves as an ideal location for C3bank's first branch outside California.

A.J. Moyer, President and CEO of C3bank, expressed enthusiasm about the growth, stating, "We are excited to expand our banking network and look forward to serving the local Nashville community. This move represents our commitment to providing top-notch banking services and building meaningful relationships with our customers."

This expansion marks a significant step for C3bank, reinforcing its reputation for excellence in personal, business, and commercial real estate banking.

“All of our C3bank locations are intended to be a business hub where local deal-making, transactions, and general business is conducted among the Nashville community,” Moyer added.

This is not just a new location; it is a testament to C3bank's ongoing commitment to growth, community engagement, and making a positive impact on the local economy. The bank looks forward to welcoming new customers and building lasting relationships in Nashville's vibrant financial landscape.

|

|

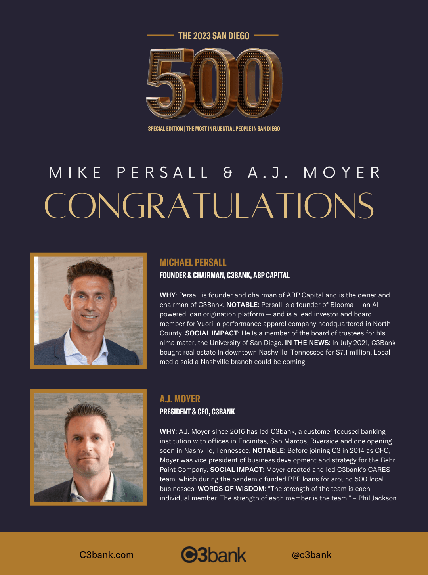

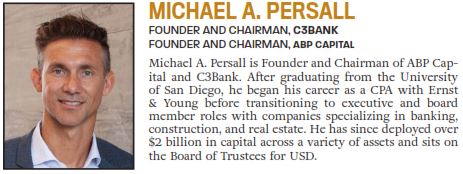

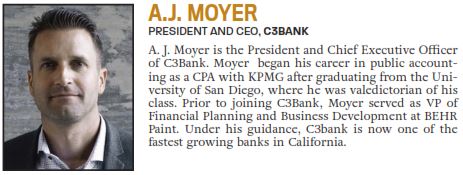

San Diego Business Journal SD500 recognizes Mike and A.J.

|

Congratulations to C3bank’s Chairman, Michael Persall, and President & CEO, A.J. Moyer, for being recognized as one of San Diego's 500 Most Influential People for 2023 by the San Diego Business Journal! The SDBJ annually recognizes 500 individuals across various industries as key players in the San Diego community who have played an integral role in how the region has grown over the years. C3bank and the executives are honored to be recognized and look forward to continuing personal and professional investment in San Diego. Read the whole article HERE. Congratulations to C3bank’s Chairman, Michael Persall, and President & CEO, A.J. Moyer, for being recognized as one of San Diego's 500 Most Influential People for 2023 by the San Diego Business Journal! The SDBJ annually recognizes 500 individuals across various industries as key players in the San Diego community who have played an integral role in how the region has grown over the years. C3bank and the executives are honored to be recognized and look forward to continuing personal and professional investment in San Diego. Read the whole article HERE.

|

|

Getting Deals Done: Surfing the American recovery’s wild economic tides

|

Patrick Howell with Coast News Group talks with A.J. Moyer in his article "Getting Deals Done: Surfing the American recovery's wild economic tides". Patrick Howell with Coast News Group talks with A.J. Moyer in his article "Getting Deals Done: Surfing the American recovery's wild economic tides".

Since the onset of the pandemic in February 2020, the coronavirus has dictated economic outcomes... Read the whole article HERE.

|

|

Archive

San Diego Business Journal - 50 Making a Difference

|

|

C3bank x Blooma makes a big impact on banking

Thank you BankDirector.com for their recent article featuring C3bank’s partnership with Blooma. Thank you BankDirector.com for their recent article featuring C3bank’s partnership with Blooma.

C3bank continues to think outside the box by partnering with key firms like Blooma to develop AI based tools to lead the new generation of banking.

Traditionally, lenders spend a lot of time manually gathering the data that factors into a potential deal. Blooma allows banks to outsource that process to its AI engines. It taps into third party databases to extract information about local real estate markets and scours the web for other relevant information, such as neighborhood crime statistics and negative news.

Read the whole article HERE

|

Design Magazine recent write-up on C3bank

Thank you Design Magazine for the recent write-up on C3bank’s Encinitas flagship location. Highlighting our interior design partners Blitz and the wonderful work they did as well as our architect, Cardiff local, Brett Farrow. “The ethos and collaborative business approach of ABP Capital and its affiliate, C3bank, are guided by three principles: honesty, transparency, and openness. These core values were the driving influences behind Blitz’s interior design of the financial company’s 15,000-square-foot headquarters in Encinitas, CA.” Thank you Design Magazine for the recent write-up on C3bank’s Encinitas flagship location. Highlighting our interior design partners Blitz and the wonderful work they did as well as our architect, Cardiff local, Brett Farrow. “The ethos and collaborative business approach of ABP Capital and its affiliate, C3bank, are guided by three principles: honesty, transparency, and openness. These core values were the driving influences behind Blitz’s interior design of the financial company’s 15,000-square-foot headquarters in Encinitas, CA.”

Read the whole article HERE

|

C3bank CEO, AJ Moyer, discusses the bank’s differentiators with SDBJ

|

|

Rather than trying to be all things to all people, today’s community banks are more likely to find a niche where they can excel and differentiate themselves from the competition. Read the entire article here.

|

Congrats Mike and AJ for being selected in SDBJ’s SD500!

Michael Persall and AJ Moyer, were recently recognized as an influential figures in the special, annual edition “San Diego Business Journal: SD500″. The San Diego Business Journal annually recognizes 500 individuals across various industries as key players in the community.

|

C3bank Aims to Be Local, National Presence

After doubling in size in just five years, C3bank was more than ready for its move into an impressive new 12,000-square-foot flagship building in downtown Encinitas. Read the full article Here.

|

|

C3bank Featured in Encinitas Magazine

The Encinitas Magazine stated, "it's definitely not just another bank, this is a locally owned and operated bank and investment group that focuses mostly on the needs of local businesses, as well as commercial real estate" - Chris Cote. Read the full article from Encinitas Magazine.

|

C3bank Opened New Flagship Location in Encinitas

Opened in Q1 2019, construction is complete on our new state of the art Banking Center. Anticipated to be the “spot” for local business meetings, the center will provide a training center for online banking, usable meeting areas for local business and coffee center for conversing and building relationships.

The San Diego Union-Tribune: Encinitas OKs see-through building

|

|

C3bank Receives a 5-Star Rating From Leading Agency, BauerFinancial

|

C3bank received a 5-star rating from independent rating agency BauerFinancial. The agency designates the bank as “Superior”, its highest rating, and features institutions with such a ranking on the BauerFinancial Recommended Report. C3bank will also be featured in the August issue of Jumbo Rate News published weekly by BauerFinancial. The issue features the top 50 banks in the nation as determined by quality loan growth. Each bank is required to be considered “well-capitalized”, considered “sound”, and have at least an "Excellent" star rating by the BauerFinancial. BauerFinancial star ratings classify each institution based upon a complex formula factoring in current and historical data. The first level of evaluation is the capital level of the institution followed by other relevant data including, but not limited, to: profitability, historical trends, loan delinquencies, repossessed assets, reserves, regulatory compliance, proposed regulations and asset quality. Negative trends are projected forward to compensate for the lag time in the data. BauerFinancial employs conservative measures when assigning these ratings and consequently our analysis may be lower than those supplied by other analysts or the institutions themselves. More than 30 years of experience has shown this to be a prudent course of action. C3bank received a 5-star rating from independent rating agency BauerFinancial. The agency designates the bank as “Superior”, its highest rating, and features institutions with such a ranking on the BauerFinancial Recommended Report. C3bank will also be featured in the August issue of Jumbo Rate News published weekly by BauerFinancial. The issue features the top 50 banks in the nation as determined by quality loan growth. Each bank is required to be considered “well-capitalized”, considered “sound”, and have at least an "Excellent" star rating by the BauerFinancial. BauerFinancial star ratings classify each institution based upon a complex formula factoring in current and historical data. The first level of evaluation is the capital level of the institution followed by other relevant data including, but not limited, to: profitability, historical trends, loan delinquencies, repossessed assets, reserves, regulatory compliance, proposed regulations and asset quality. Negative trends are projected forward to compensate for the lag time in the data. BauerFinancial employs conservative measures when assigning these ratings and consequently our analysis may be lower than those supplied by other analysts or the institutions themselves. More than 30 years of experience has shown this to be a prudent course of action.

|

|

|

|